Singapore VS Hong Kong : Where is the best place to do business 2023?

08-06-2023

Singapore and Hong Kong have been vying for dominance as Asia’s ‘Best Place to Do Business’ for decades. Both regions have enticed international investors with tax-friendly regulations, simple firm incorporation procedures, and superb infrastructure, among other things. Although Hong Kong has a longer history as a corporate center, Singapore has quickly caught up, eroding Hong Kong’s supremacy in the area. Singapore has been fast to implement business-friendly regulations that have attracted the majority of global companies to build their Asian presence on its shores.

Singapore and Hong Kong have been vying for dominance as Asia’s ‘Best Place to Do Business’ for decades. Both regions have enticed international investors with tax-friendly regulations, simple firm incorporation procedures, and superb infrastructure, among other things. Although Hong Kong has a longer history as a corporate center, Singapore has quickly caught up, eroding Hong Kong’s supremacy in the area. Singapore has been fast to implement business-friendly regulations that have attracted the majority of global companies to build their Asian presence on its shores.

There is no simple black-and-white response to the issue of which jurisdiction is today more appealing. It is a very competitive environment, and some investors select Singapore for lifestyle reasons or for the strength of infrastructure and service suppliers. Some select Hong Kong primarily to gain access to the larger Chinese and North Asian markets. Smaller enterprises frequently select Singapore because it offers more appealing tax incentives and a lower cost environment than its competitor. This article will guide you all things about political atmosphere, economic environment, legal landscape, taxation policies and general ease of doing business are all factors to consider.

1. Political Situation

In 2010, the Political and Economic Risk Consultancy assessed Singapore as the second most politically stable country in Asia, after only Hong Kong. Singapore’s stable and pro-business governmental environment has increased its credibility as an international business hub, with an increasing number of businesses preferring to establish operations here. Transparency, high levels of honesty, tough law enforcement, corruption control, market-friendly policy design, and competent policy execution have become the Singapore Government’s hallmarks.

Hong Kong is a People’s Republic of China Special Administrative Region with significant autonomy in all areas except foreign and defense affairs. Hong Kong preserves its political, economic, and judicial systems, according to the Sino-British Joint Declaration (1984) and the Basic Law. This configuration is known as “One China, Two Systems.” The attraction of the city is based on its political stability, pro-business government, and free market ideals. It is also regarded as one of the world’s least corrupt economies.

2. Economic Situation

Singapore has positioned itself as the most competitive Asian country through robust trade and investment. Exports of electronics and machinery underpin the economy, with financial services and tourism also playing important roles. Singapore’s GDP per capita is double that of Thailand, Malaysia, Indonesia, and the Philippines combined. Singapore’s GDP increased by 14.5% in 2010, although annual inflation remained moderate at 2.1%. Its primary economic strengths include zero foreign debt, strong government revenue, and a constant positive surplus. Singapore is also the world’s fourth largest foreign exchange trading hub. For more information about Singapore’s economic situation, please click here https://www.guidemesingapore.com/business-guides/incorporation/why-singapore/singapore-economy—a-brief-introduction

Hong Kong has one of the most dynamic economies in the world, driven by the values of free entrepreneurship, free trade, and open markets to everyone. Over the last two decades, the vigorous economy has contributed to GDP growth at an average annual rate of 5% in real terms. There are no limits on inbound and outward investment, no foreign exchange controls, and no prohibitions on foreign ownership. Hong Kong’s economic strengths include a robust banking system, almost no public debt, a strong legal system, substantial foreign exchange reserves, and an effective and strictly implemented anti-corruption framework.

3. Legal Situation

Singapore and Hong Kong have also been upgrading their infrastructure to satisfy the expanding demands of enterprises. Both locations boast the world’s best airports and busiest ports. Transportation services are both efficient and inexpensive, linking all main centers in their respective regions. Singapore and Hong Kong are competing to be the favored Exhibition and Convention Centre. In addition, each area has seen the development of significant industrial and business parks.

The telecommunications infrastructure in Hong Kong and Singapore is among the most technologically sophisticated in the world. Almost all business and residential buildings have broadband coverage. Because of Hong Kong’s open marketplaces, there are several competitive mobile phone and Internet service providers.

4. Taxation

Taxes are at the top of any entrepreneur’s priority list and one of the most important factors to consider when establishing a business in a specific jurisdiction. Singapore’s low effective personal and corporate tax rates are one of its distinguishing features. In both areas, personal income tax is levied in tiers. Personal income tax rates in Singapore begin at 3.5% and rise to 20% for earnings over SGD 320,000. Personal income tax, or salary tax, in Hong Kong begins at 2% and rises to 17% for earnings beyond HKD 120,000. Singapore, on the other hand, has a substantially lower net effective personal income tax rate than Hong Kong. An individual earning USD 65,000 in Hong Kong, for example, would wind up paying close to USD 6,500 in personal income tax. In Singapore, he would just have to pay around USD 4,000.

In Singapore, like in many other jurisdictions, the headline corporate tax rate does not often offer an accurate representation of the actual corporate tax rate. Due to relevant tax exemptions and tax incentives, depreciation regulations, and so forth, the effective rate is typically lower than the headline tax rate. When these tax exemptions are applied to taxable income, the effective tax rates for small-to-medium-sized Singapore enterprises are much lower than the corporation tax rate due in Hong Kong. The effective corporation tax rate for Singapore private limited firms is restricted at 17% for profits up to SGD 300,000 and 15% for profits exceeding SGD 300,000. However, newly established Singapore incorporated start-ups are excused from paying tax on the first S$100,000 in income made for three consecutive years, and 50% on the next S$200,000. With effect from 2010, the government has also modified its partial and full-tax exemption plans for start-ups, allowing them to benefit from either CIT refunds or SME cash awards.

5. Ease of doing business

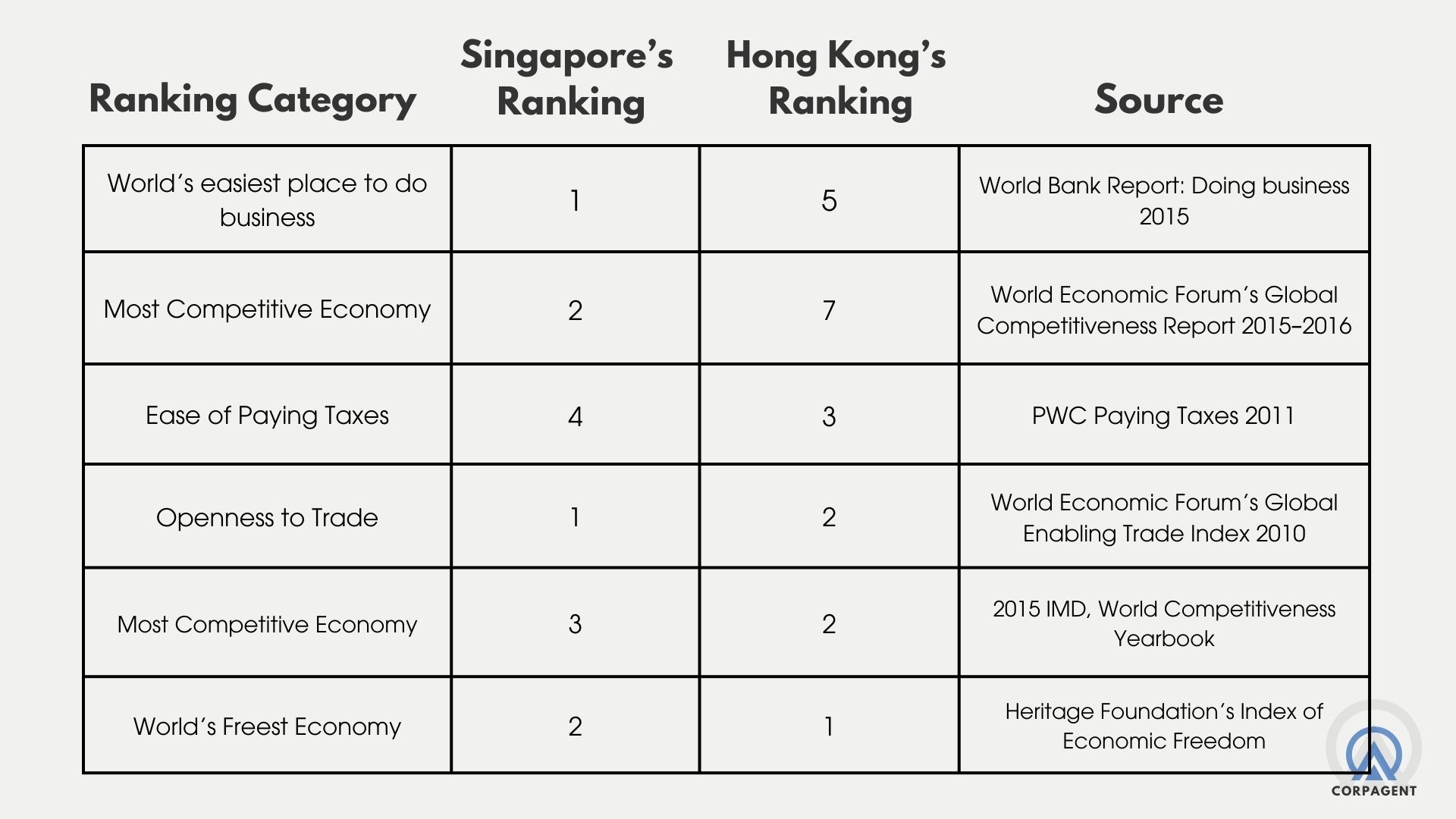

In both economies, incorporating a firm requires only three procedures and 1-3 days. Singapore, on the other hand, fared substantially better in terms of contract enforcement (1 vs. HK’s 22) and property registration (17 vs. HK’s 59). Singapore and Hong Kong are scored highly when compared to the Asian region’s 7 procedures and 38 days.

Conclusion

Given Singapore’s emergence as a strong rival for international business, Hong Kong is no longer the only place in the Asian region to do business. Additionally, Hong Kong is no longer as attractive as it used to be – it scores low on quality of life and high on cost of living, qualified labor at affordable costs is no longer as easily available, English usage is declining and the business community has concerns over the region’s political stability in the future. Singapore being Hong Kong’s most immediate competitor has addressed all these concerns and is even offering generous tax incentives to woo investors. And if you’re interested in doing business in Hong Kong or Singapore, CorpAgent Global will provide you with a detailed consultant. Contact us for more information https://corpagent.asia/

See more HONG KONG and SINGAPORE content here:

https://corpagent.asia/risks-tips-for-opening-a-bank-account-for-start-ups-in-hong-kong/

https://corpagent.asia/singapore-or-hong-kong-guide-for-foreigners/

Other News

Singapore VS Hong Kong : Where is the best place to do business 2023?

Singapore and Hong Kong have been vying for dominance as Asia’s ‘Best Place to Do Business’ for decades. Both regions have enticed international investors with tax-friendly regulations, simple firm incorporation procedures, and superb infrastructure, among other things. Although Hong Kong has a longer history as a corporate center, Singapore has quickly caught up, eroding Hong Kong’s supremacy in the area. Singapore has been fast to implement business-friendly regulations that have attracted the majority of global companies to build their Asian presence on its shores.

What documents are required for opening a business bank account in Singapore 2023?

When you’re ready to start taking or spending money as your business, open a business account. A business bank account keeps you legally compliant and safe. It also has advantages for your customers and workers.

Today, we’ll look at Singapore’s banking business, which is a sophisticated financial ecosystem of local and foreign institutions. You will learn about the procedures for creating a corporate bank account, the required documentation, and the variety of banking services. And if you’re interested in opening a business bank account in Singpore, we’ll provide you with consultancy to help you, please contact us through https://corpagent.asia/

RISKS & TIPS FOR OPENING A BANK ACCOUNT FOR START-UPS IN HONG KONG

The difficulty of obtaining commercial bank accounts in Hong Kong has been well – recognized in recent years. It is also really complicated. Despite media attention and pressure from the Hong Kong Monetary Authority, InvestHK, Chambers of Commerce, and Hong Kong business organizations, opening bank accounts remains difficult for start-ups and small and medium-sized firms in particular.

Top 3 Crypto Exchanges Singapore 2023

Singapore is a prominent financial center that has experienced an increase in cryptocurrency use. Investors are seeking for the finest crypto exchange in Singapore, with up to 93% of its population having moderate knowledge of the crypto business.

This article will guide you some newest and safest pros and cons, provided base on top reviewers of top 3 crypto exchanges in Singapore: