CorpAgent Exclusive: PayPal Pro For Hong Kong Company

08-01-2020

The demand for cross-border shopping is only increasing with the advancement of the Internet and logistics companies. The demand for shopping of non-necessity goods might be slowed down a tad bit by the recession, but the pushing factors on the other hand are making up for the dent, and cross-border e-commerce businesses themselves are keeping up with their confidence in order to not lose what they have built and, if possible, expand in 2023. Major international payment companies, like PayPal and Stripe, are keeping these behaviors in check. Over the past few years, they have been doing everything possible to facilitate the business of cross-border e-commerce. In this article, we go through one of PayPal’s most significant launches: the PayPal Payment Pro, which has been playing a margin boosting role for hundreds of thousands of dropshipping businesses.

Table of Content

|

About PayPal PayPal Pro for PayPal Business PayPal Pro vs. PayPal Business CorpAgent’s PayPal Pro Package |

About PayPal

PayPal is one of the world’s largest if not the largest payment platform. PayPal has long been one of the indispensable options for cross-border e-commerce businesses, especially those who have deep interest in the US market. There are two types of PayPal accounts: Personal PayPal account, and Business PayPal account (PayPal Business)

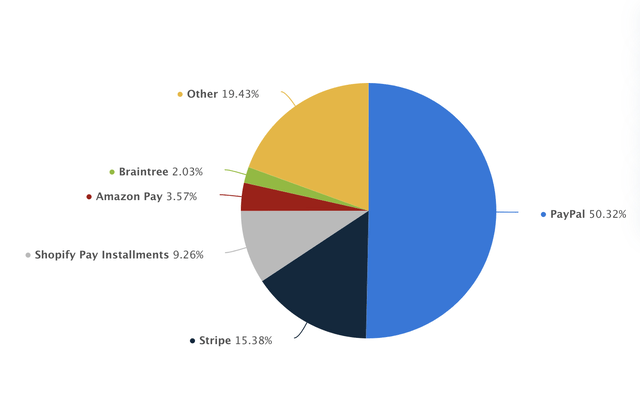

Figure 1: PayPal’s market share

Personal PayPal account

Everyone can open a personal PayPal account, including businesses! In fact, many dropshipping starters use personal PayPal accounts as an alternative, but it only works until the seller reaches a certain level of monthly transactions. Despite its low transaction fee, a personal PayPal account comes with low transaction limits and business risks. It does not come with the level of protection that does a PayPal Business account. When getting into disputes, personal PayPal accounts face higher risks of being permanently dis-functioned.

PayPal Business

PayPal Business is the type of PayPal account designed for cross-border e-commerce and Internet service businesses. Unlike personal accounts, the business account takes more work to get onboard and is more costly to maintain, but comes with higher transaction limits and lower business risks.

PayPal Pro for PayPal Business

PayPal Pro is a service made for high-volume accounts. PayPal Pro helps e-commerce businesses enhance customer experience while improving operational and cost efficiency. The main advantages of PayPal Pro include:

- Sellers can control 100% the checkout process, unlike for PayPal (not Pro!), customers will be redirected to the PayPal checkout window.

- Shoppers can perform payment directly from their debit/credit card through PayPal Pro. Shoppers don’t need a PayPal account themselves to pay with PayPal Pro.

- The maximum transaction limit for PayPal Pro is much higher than for PayPal.

- Settlement time is much shorter than PayPal, especially for high trust accounts.

The only tingles for PayPal Pro is that it can be inaccessible to businesses incorporated in certain countries. For example, businesses based in most countries in Southeast Asia are not qualified for PayPal Pro. Fortunately, offshore companies exist and that has been quite the practice for long. For businesses based in countries NOT SUPPORTED by PayPal, they can feel free to form a new business in a supported country. There are no limits to which countries one can opt in for, and you can totally see more of CorpAgent’s company formation services here. In this article, however, we present you one of the most popular options.

If you already know what PayPal Pro brings, jump to our plan below.

PayPal Pro vs. PayPal Business

| PayPal Business | PayPal Payments Pro | |

| Store checkout | No | Yes |

| Seller’s 100% control over the checkout process to increase conversion | Limited | Great flexiblity |

| Acceptance of debit and credit card payments | Yes | Yes |

| Acceptance of debit and credit card payments without PayPal accounts | Yes | Yes |

| Transaction limit |

Transaction limits depend on:

Transaction limits vary between accounts. Account owners can check their transaction limits by following these instructions:

New accounts usually have lower transaction limits than long-running and high-trust accounts |

PayPal Business accounts can opt to go through an underwriting process to obtain a PayPal Pro status. PayPal Pro accounts are granted higher transaction limits compared to normal PayPal Business accounts. Monthly transaction volumes will also be higher. PayPal Pro accounts are usually granted a transaction limit as high as USD 10,000 (maximum USD 10,000 per transfer) |

CorpAgent’s PayPal Pro Package

Step 1: Company Formation in Hong Kong

Form a company in Hong Kong if you haven’t had one.

Step 2: PayPal Business Account Registration for the newly-formed Hong Kong Company

Registration in and of itself is simple, but everyone knows it can be tricky. For those who have repeatedly been rejected or questioned by PayPal, this is one of those time you will be in need of professional help. CorpAgent guides you through the registration process and gives you the expert’s opinion on how to actual run your PayPal Business account to avoid limitation.

Step 3: Verification for PayPal Business Account through PayPal Hong Kong

After taking inquiry from PayPal, PayPal Hong Kong will send you a registration form and a list of relevant questions to inspect about the company’s business activities. For the underwriting process, this list could be tiring! CorpAgent will guide you through the due diligence process and most of all, due to our long-time partnership with PayPal Hong Kong, we will be able to give you the most useful advice on how to fill in the forms correctly, how to prepare the documents most effectively, etc. so as your underwriting process will go on as smoothly.

Step 4: PayPal Pro Operations

After the registration form has been completed and successfully submitted, your business will officially own a PayPal Pro account. You will be immediately be able to operate with your PayPal Pro account. However, CorpAgent may still be useful to you as we give insightful advice on how to avoid account limitations or how to navigate around your transaction volume without getting into trouble. CorpAgent also offers you around-the-clock support as our customer success specialists are always ready to link you with PayPal Hong Kong and solve your problems the fastest possible.

Simple as it may sound, the underwriting process leading to the long-term operations of a PayPal Business or PayPal Payments Pro account requires hard work and insights from the professionals. Years in the business, CorpAgent believes that nothing but expertise, experience, valuable partnerships, and transparency make a professional stand out from the others.

CorpAgent is proficient in its area. But more so, we have 10 years+ in the business and a strong bond with PayPal Hong Kong. We have helped thousands of foreign businesses start with PayPal Business and PayPal Payments Pro, and we look forward to helping more as we develop more insights and form a stronger bond with PayPal Hong Kong (and PayPal Singapore, for those who are interested), we are confident that our service quality is unmatched especially in the SEA/APAC region.

CorpAgent is also a long-time provider of Singapore corporate services including:

Company Formation in Hong Kong

Company Formation in Singapore (for associations with PayPal Singapore)

To get an exclusive quote on our PayPal Payments Pro Underwriting package, send us an inquiry to admin@corpagent.asia, or fill in the Contact Form here.

Also, follow our Facebook Fanpage for updates.

Related content about PayPal Pro for Singapore Companies

Company Formation in Singapore

Company Formation in Hong Kong (for associations with PayPal Hong Kong)

Other News

Singapore VS Hong Kong : Where is the best place to do business 2023?

Singapore and Hong Kong have been vying for dominance as Asia’s ‘Best Place to Do Business’ for decades. Both regions have enticed international investors with tax-friendly regulations, simple firm incorporation procedures, and superb infrastructure, among other things. Although Hong Kong has a longer history as a corporate center, Singapore has quickly caught up, eroding Hong Kong’s supremacy in the area. Singapore has been fast to implement business-friendly regulations that have attracted the majority of global companies to build their Asian presence on its shores.

What documents are required for opening a business bank account in Singapore 2023?

When you’re ready to start taking or spending money as your business, open a business account. A business bank account keeps you legally compliant and safe. It also has advantages for your customers and workers.

Today, we’ll look at Singapore’s banking business, which is a sophisticated financial ecosystem of local and foreign institutions. You will learn about the procedures for creating a corporate bank account, the required documentation, and the variety of banking services. And if you’re interested in opening a business bank account in Singpore, we’ll provide you with consultancy to help you, please contact us through https://corpagent.asia/

RISKS & TIPS FOR OPENING A BANK ACCOUNT FOR START-UPS IN HONG KONG

The difficulty of obtaining commercial bank accounts in Hong Kong has been well – recognized in recent years. It is also really complicated. Despite media attention and pressure from the Hong Kong Monetary Authority, InvestHK, Chambers of Commerce, and Hong Kong business organizations, opening bank accounts remains difficult for start-ups and small and medium-sized firms in particular.

Top 3 Crypto Exchanges Singapore 2023

Singapore is a prominent financial center that has experienced an increase in cryptocurrency use. Investors are seeking for the finest crypto exchange in Singapore, with up to 93% of its population having moderate knowledge of the crypto business.

This article will guide you some newest and safest pros and cons, provided base on top reviewers of top 3 crypto exchanges in Singapore: