Tax – Accounting & Auditing

Why choose us in this field

Reduced taxation

Secure your intelligent property

Access to tax treaties

Enhance assets

Fewer restrictions

Political stability

Consultancy contact

Please fill in the form below and send your comments and questions to JNT Consultancy & Services, we will respond to your email as soon as possible.

Jurisdictions

Our experienced team of professional accountants, who have vast experience working in different jurisdictions, which allows us to offer the best solutions and help to improve your company’s performance by focusing on the key areas and to reduce the administrative expenses

Process of Auditing

Whether you are doing business in Europe, Asia, Africa, the Middle East, the Americas or elsewhere, CorpAgent will set up the best trading or holding structure for your business in line with local laws and regulations.

Preparation

- Request free company name search We check the eligibility of the name, and make suggestion if necessary.

Your Company Details

- Register or login and fill in the company names and director/ shareholder(s).

- Fill in shipping, company address or special request (if any).

Payment for Your Favorite Company

- Choose your payment method (We accept payment by Credit/Debit Card, PayPal or Wire Transfer).

Send the Company Kit to Your Address

- You will receive soft copies of necessary documents including: Certificate of Incorporation, Business Registration, Memorandum and Articles of Association, etc. Then, your new company in a jurisdiction is ready to do business!

- You can bring the documents in the company kit to open a corporate bank account or we can help you with our long experience of Banking support service.

Nominee

What are nominee services?

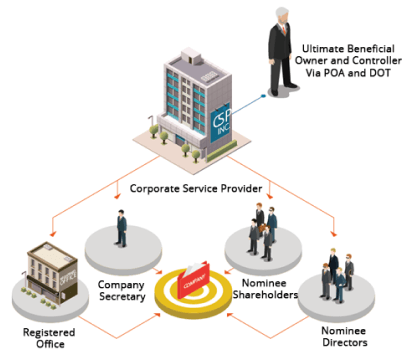

A Nominee service is a legal way of protecting the identity and anonymity of the company owner. The main function of nominee directors or shareholders is to maintain the anonymity of the real owner by taking their place in all public records relating to the company and non-governmental bodies.

Overview of nominee services

Nominee information

We will provide you with a copy of the nominee’s passport and proof of their address.

Power of attorney for nominee director (with apostille)

Your company’s rights will be protected under a power of attorney. This will certify that you have full control of the company and the nominee director only represents you. All actions made by the nominee director will be taken under this contract until it ends. Then all rights will revert back to you and the nominee can no longer act on your behalf.

Declaration of trust for nominee shareholder

If you appoint a nominee shareholder, you will need to protect your rights to your shares. Issuing a declaration of trust without any loopholes helps you to confirm your full ownership of your shares while the nominee represents you.

To help you understand, the picture below shows the structure.

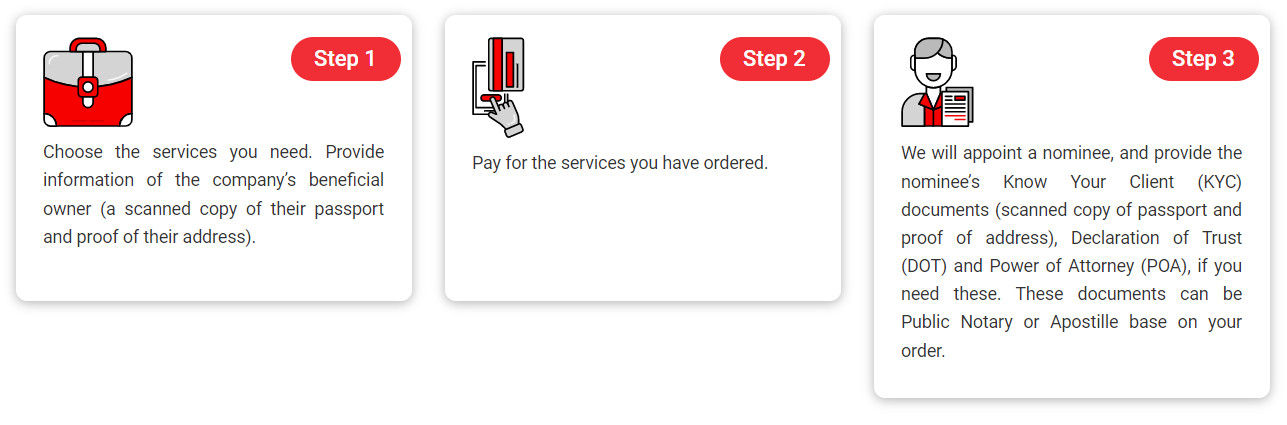

How does nominee service work?

Notes

- Service fee is per annum/per appointment.

- The service fee does not cover the fee for couriering the original copy of the POA or DOT to your residential address.

- You can open a bank account for your company with the POA and/or DOT we provided.

- An apostille is a certification and legalisation of documents by the government, normally the General Registry/Court of the local country.

Notes Service fee is per annum/per appointment. The service fee does not cover the fee for couriering the original copy of the POA or DOT to your residential address. You can open a bank account for your company with the POA and/or DOT we provided. An apostille is a certification and legalisation of documents by the government, normally the General Registry/Court of the local country.

| Services | Service fee | Description |

|---|---|---|

| Nominee shareholder | US$ 899 | |

| Nominee director | US$ 899 | |

| Power of attorney (POA) documents | US$ 649 | Nominee director’s signature only |

| Power of attorney with certification by public notary | US$ 779 | Certification by notary of detail documents of POA |

| Declaration of trust (DOT) | US$ 649 | |

| Declaration of trust (DOT) with certification by public notary | US$ 779 | Certification by notary of detail documents of DOT |

| Power of attorney (POA) with apostille documents | US$ 899 | Certification on documents by General Registry/Court |

| Courier fee | US$ 150 | Courier the original document to your residential address with express services (TNT or DHL) |

| Nominee Trustor | US$ 1,299 | |

| Nominee Trustee | US$ 1,299 | |

| Nominee Council | US$ 1,299 | |

| Nominee Founder | US$ 1,299 |

Notes:

- Service fee is per annum/per appointment.

- The service fee does not cover the fee for couriering the original copy of the POA or DOT to your residential address.

- You can open a bank account for your company with the POA and/or DOT we provided.

- Certification by pubic Notary or Apostille is required for nominee services in Hong Kong, United Kingdom and Singapore.

- An apostille is a certification and legalisation of documents by the government, normally the General Registry/Court of the local country.

Change Agent

Why change agent?

When you first incorporate an offshore company, you start with tax planning and legal matters. This does not mean you will not have any issues in the future. Issues may not just be related to finances, they may relate to supporting, maintaining and advising your company from year to year and dealing with some matters during the life of your business. You have to choose the proper provider or registered agent to serve your offshore structure during its lifetime.

In case your company already had the Registered Agent but you do not like the way they support the company, they cannot provide the request services. You are not happy with your choice and you want to change, you want to choose another one, if so, we can help you change the Registered Agent (or Secretary).

Company Renewal

Overview

As your Registered Agent/Company Secretary, it is our duty to remind & support you to renew and comply with any legal requirement asked by the Government. Renewal is a must to all company, in order to keep its good standing status with the Government, maintain the business and also the company bank account. Depend on each Jurisdiction, the annual due date will be different and we will remind you on time about this to avoid any penalty fee. To find out about the annual due date of your company, please see the below Fees Schedule for more information.

Scope of Services

- Reminder emails/letters about the annual due date.

- Inform any news/legal requirements asked by the Government.

- Provision of Company Secretaries, Registered Address.

- Preparation and filing of annual returns.

- Preparation and filing of licence applications (if any).

- Preparation, filing and payment of Government fees.

- Depend on the Jurisdiction, Accounting & Auditing will be required (Hong Kong, Singapore or UK, etc).

- Updated documents such as Business License, Annual Return, Confirmation Receipt, etc will be provided after finishing the Renewal process.

Legal Action against non-renewal company

Non-payment of annual renewal fees will incur severe late penalties, legal consequences and at risk of frozen Bank account. Example: For Hong Kong company, the Annual Return must be filed within 42 days since the anniversary date of incorporation. An additional fee will be charged if the filing date is passed and will increase for each period. Failure to comply, the company and the officer(s) will be liable for fine or receive a summon letter from Hong Kong High Court. In the worst case scenario, the company may be at risk of struck-off by not arrange the Annual Renewal fee on time.

Fee Schedule

Asia Pacific

Hong Kong

Hong Kong

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Company Limited by Shares (recommend) | US$ 1,290

|

Anniversary date |

| Company Limited by Guarantee | US$ 1,574

|

Anniversary date |

Singapore

Singapore

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Exempt Private Limited Company (Pte.Ltd) | US$ 4,377

|

Anniversary date |

| Public Limited Company | US$ 7,640

|

Anniversary date |

Samoa

Samoa

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| International Company (IC) | US$ 1,782

|

30 November of each year |

Marshall Islands

Marshall Islands

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| International Business Company (IBC) | US$ 1,613

|

Anniversary date |

| Limited Liability Company (LLC) | US$ 2,137

|

Anniversary date |

Vanuatu

Vanuatu

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| International Company (BC) | US$ 2,961

|

Anniversary date |

Labuan, Malaysia

Labuan, Malaysia

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Company Limited by Shares | US$ 6,695

|

Anniversary date |

Vietnam

Vietnam

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Wholly foreign-owned LLC (100% foreign-owned company in Vietnam) | US$ 199

|

Anniversary date |

| Partly foreign-owned LLC (The Vietnam joint venture company) | US$ 199

|

Anniversary date |

Europe

United Kingdom

United Kingdom

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Private Limited | US$ 1,298

|

Anniversary date |

| Public Limited | US$ 1,298

|

Anniversary date |

| LLP | US$ 1,298

|

Anniversary date |

Cyprus

Cyprus

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Private Limited | US$ 3,935

|

30 June of each year |

Switzerland

Switzerland

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company | US$ 11,812

|

Anniversary date |

| Stock Corporation | US$ 11,812

|

Anniversary date |

| Sole Proprietorship | US$ 11,812

|

Anniversary date |

Gibraltar

Gibraltar

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Private Limited by Shares | US$ 2,689

|

Anniversary date |

Malta

Malta

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Private Limited Liability Company | US$ 4,189

|

Anniversary date |

Netherlands

Netherlands

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 6,226

|

Anniversary date |

Luxembourg

Luxembourg

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Soparfi Holding | US$ 11,846

|

Anniversary date |

| S.A.R.L: Private Limited Company | US$ 18,338

|

Anniversary date |

Liechtenstein

Liechtenstein

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| AG | US$ 14,336

|

Anniversary date |

| Anstalt | US$ 14,405

|

Anniversary date |

Caribbean

British Virgin Islands

British Virgin Islands

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Business Company (BC) | US$ 2,056

|

31 May next year (Incorporation from 01 January to 30 June) 30 November next year (Incorporation from 01 July to 31 December) |

Belize

Belize

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| International Business Company (IBC) | US$ 1,309

|

IBC: 02 January of each year. |

| Limited Liability Company (LLC) | US$ 1,733

|

LLC: Anniversary date |

Cayman Islands

Cayman Islands

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Exempted (Limited by Shares) | US$ 4,086

|

31 December of each year |

| Limited Liability Company (LLC) | US$ 4,628

|

31 December of each year |

Anguilla

Anguilla

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| International Business Company (IBC) | US$ 1,680

|

Jan 1st next year (Incorporation from Jan 1st to Mar 31st) Apr 1st next year (Incorporation from Apr 1st to Jun 30th) Jul 1st next year (Incorporation from Jul 1st to Sep 30th) Oct 1st next year (Incorporation from Oct 1st to Dec 31st) |

The Bahamas

The Bahamas

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| International Business Company (IBC) | US$ 2,539

|

31 December of each year |

Panama

Panama

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Non Resident | US$ 2,520

|

01 January next year (Incorporation from 01 January to 30 June). 01 July next year (Incorporation from 01 July to 31 December). |

Saint Vincent and the Grenadines

Saint Vincent and the Grenadines

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 2,420

|

31 December of each year |

Saint Kitts and Nevis

Saint Kitts and Nevis

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Nevis Business Corporation (NBCO) | US$ 2,071

|

Anniversary date |

| Limited Liability Company (LLC) | US$ 2,021

|

Anniversary date |

Middle East

United Arab Emirates (UAE)

United Arab Emirates (UAE)

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| IBC | US$ 3,841

|

Anniversary date |

| RAK Free Zone | US$ 4,561

|

Anniversary date |

| Dubai Free Zone (DMCC) | US$ 14,565

|

Anniversary date |

| Ajman Free Zone | US$ 4,223

|

Anniversary date |

| Local Company (Commercial, Trading Or Professional License) | US$ 16,129

|

Anniversary date |

| Local Company (General Trading) | US$ 22,129

|

Anniversary date |

Africa

Seychelles

Seychelles

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| International Business Company (IBC) | US$ 1,073

|

Anniversary date |

Mauritius

Mauritius

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Global Business Company (GBC 1) | US$ 30,833

|

01 January of each year |

| Authorised Company (AC) | US$ 3,142

|

01 January of each year |

America

Delaware (United States of America)

Delaware (United States of America)

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 1,928

|

Jun 01st Annually |

| Corporation (C-Corp or S-Corp) | US$ 1,928

|

March 01st Annually |

United States of America

United States of America

![]() Alaska

Alaska

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 1,099

|

Due every 2 years, starting from when you filed your Initial Report. |

| Corporation (C-Corp or S-Corp) | US$ 899

|

Due every 2 years, starting from when you filed your Initial Report. |

![]() Alabama

Alabama

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 899

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 999

|

Anniversary date |

![]() Arkansas

Arkansas

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 799

|

May 1st every year |

| Corporation (C-Corp or S-Corp) | US$ 789

|

May 1st every year |

![]() Arizona

Arizona

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 869

|

No Annual Report is required. |

| Corporation (C-Corp or S-Corp) | US$ 889

|

Due annually by anniversary of formation or registration. You can start filing 3 months prior. |

![]() California

California

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 1,040

|

15th day of the 4th month after the beginning of your tax year |

| Corporation (C-Corp or S-Corp) | US$ 1,240

|

15th day of the 4th month after the close of your tax year |

![]() Colorado

Colorado

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 999

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 799

|

Anniversary date |

![]() Connecticut

Connecticut

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 939

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 999

|

Anniversary date |

![]() Delaware

Delaware

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 1,429

|

Jun 01st Annually |

| Corporation (C-Corp or S-Corp) | US$ 1,429

|

March 01st Annually |

![]() Florida

Florida

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 949

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 999

|

Anniversary date |

![]() Georgia

Georgia

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 899

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 799

|

Anniversary date |

![]() Hawaii

Hawaii

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 799

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 749

|

Anniversary date |

![]() Iowa

Iowa

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 799

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 799

|

Anniversary date |

![]() Idaho

Idaho

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 899

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 899

|

Anniversary date |

![]() Illinois

Illinois

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 899

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 899

|

Anniversary date |

![]() Indiana

Indiana

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 889

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 879

|

Anniversary date |

![]() Kansas

Kansas

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 1,099

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 999

|

Anniversary date |

![]() Kentucky

Kentucky

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 779

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 779

|

Anniversary date |

![]() Louisiana

Louisiana

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 899

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 849

|

Anniversary date |

![]() Massachusetts

Massachusetts

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 1,299

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 1,099

|

Anniversary date |

![]() Maryland

Maryland

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 899

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 899

|

Anniversary date |

![]() Maine

Maine

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 989

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 999

|

Anniversary date |

![]() Michigan

Michigan

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 749

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 749

|

Anniversary date |

![]() Minnesota

Minnesota

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 799

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 969

|

Anniversary date |

![]() Missouri

Missouri

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 909

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 909

|

Anniversary date |

![]() Mississippi

Mississippi

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 799

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 799

|

Anniversary date |

![]() Montana

Montana

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 839

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 839

|

Anniversary date |

![]() North Carolina

North Carolina

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 949

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 949

|

Anniversary date |

![]() North Dakota

North Dakota

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 899

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 899

|

Anniversary date |

![]() Nebraska

Nebraska

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 899

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 899

|

Anniversary date |

![]() New Hampshire

New Hampshire

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 899

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 899

|

Anniversary date |

![]() New Jersey

New Jersey

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 949

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 949

|

Anniversary date |

![]() New Mexico

New Mexico

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 799

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 949

|

Anniversary date |

![]() Nevada

Nevada

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 1,498

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 1,758

|

Anniversary date |

![]() New York

New York

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 949

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 949

|

Anniversary date |

![]() Ohio

Ohio

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 899

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 897

|

Anniversary date |

![]() Oklahoma

Oklahoma

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 899

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 799

|

Anniversary date |

![]() Oregon

Oregon

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 899

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 899

|

Anniversary date |

![]() Pennsylvania

Pennsylvania

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 949

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 1,099

|

Anniversary date |

![]() Rhode Island

Rhode Island

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 999

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 999

|

Anniversary date |

![]() South Carolina

South Carolina

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 919

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 919

|

Anniversary date |

![]() South Dakota

South Dakota

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 999

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 759

|

Anniversary date |

![]() Tennessee

Tennessee

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 799

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 799

|

Anniversary date |

![]() Texas

Texas

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 999

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 1,099

|

Anniversary date |

![]() Utah

Utah

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 839

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 839

|

Anniversary date |

![]() Virginia

Virginia

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 849

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 739

|

Anniversary date |

![]() Vermont

Vermont

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 949

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 949

|

Anniversary date |

![]() Washington

Washington

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 1,059

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 1,059

|

Anniversary date |

![]() Wisconsin

Wisconsin

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 1,039

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 1,039

|

Anniversary date |

![]() West Virginia

West Virginia

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 899

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 899

|

Anniversary date |

![]() Wyoming

Wyoming

| Type Of Incorporation | Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) | US$ 799

|

Anniversary date |

| Corporation (C-Corp or S-Corp) | US$ 799

|

Anniversary date |

Note: The late penalty will be automatically applied once pass the deadline.

Penalty Fee Schedule

Asia Pacific

Hong Kong

Hong Kong| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Company Limited by Shares (recommend) |

|

Anniversary date |

| Company Limited by Guarantee |

|

Anniversary date |

Singapore

Singapore| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Exempt Private Limited Company (Pte.Ltd) |

|

Anniversary date |

| Public Limited Company |

|

Anniversary date |

Samoa

Samoa| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| International Company (IC) |

|

30 November of each year |

Marshall Islands

Marshall Islands| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| International Business Company (IBC) |

|

Anniversary date |

| Limited Liability Company (LLC) |

|

Anniversary date |

Vanuatu

Vanuatu| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| International Company (BC) |

|

Anniversary date |

Labuan, Malaysia

Labuan, Malaysia| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Company Limited by Shares |

Late renewal in less then 6 months:

|

Anniversary date |

Vietnam

Vietnam| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Wholly foreign-owned LLC (100% foreign-owned company in Vietnam) | Anniversary date | |

| Partly foreign-owned LLC (The Vietnam joint venture company) | Anniversary date |

Europe

United Kingdom

United Kingdom| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Private Limited |

|

Anniversary date |

| Public Limited |

|

Anniversary date |

| LLP |

|

Anniversary date |

Cyprus

Cyprus| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Private Limited |

|

30 June of each year |

Switzerland

Switzerland| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company |

|

Anniversary date |

| Stock Corporation |

|

Anniversary date |

| Sole Proprietorship |

|

Anniversary date |

Gibraltar

Gibraltar| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Private Limited by Shares |

|

Anniversary date |

Malta

Malta| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Private Limited Liability Company |

|

Anniversary date |

Netherlands

Netherlands| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

Luxembourg

Luxembourg| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Soparfi Holding |

|

Anniversary date |

| S.A.R.L: Private Limited Company |

|

Anniversary date |

Liechtenstein

Liechtenstein| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| AG |

|

Anniversary date |

| Anstalt |

|

Anniversary date |

Caribbean

British Virgin Islands

British Virgin Islands| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Business Company (BC) |

|

31 May next year (Incorporation from 01 January to 30 June) 30 November next year (Incorporation from 01 July to 31 December) |

Belize

Belize| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| International Business Company (IBC) |

|

IBC: 02 January of each year. |

| Limited Liability Company (LLC) |

|

LLC: Anniversary date |

Cayman Islands

Cayman Islands| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Exempted (Limited by Shares) |

|

31 December of each year |

| Limited Liability Company (LLC) |

|

31 December of each year |

Anguilla

Anguilla| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| International Business Company (IBC) |

|

Jan 1st next year (Incorporation from Jan 1st to Mar 31st) Apr 1st next year (Incorporation from Apr 1st to Jun 30th) Jul 1st next year (Incorporation from Jul 1st to Sep 30th) Oct 1st next year (Incorporation from Oct 1st to Dec 31st) |

The Bahamas

The Bahamas| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| International Business Company (IBC) |

|

31 December of each year |

Panama

Panama| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Non Resident |

|

01 January next year (Incorporation from 01 January to 30 June). 01 July next year (Incorporation from 01 July to 31 December). |

Saint Vincent and the Grenadines

Saint Vincent and the Grenadines| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

31 December of each year |

Saint Kitts and Nevis

Saint Kitts and Nevis| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Nevis Business Corporation (NBCO) |

|

Anniversary date |

| Limited Liability Company (LLC) |

|

Anniversary date |

Middle East

United Arab Emirates (UAE)

United Arab Emirates (UAE)| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| IBC |

|

Anniversary date |

| RAK Free Zone |

|

Anniversary date |

| Dubai Free Zone (DMCC) |

|

Anniversary date |

| Ajman Free Zone |

|

Anniversary date |

| Local Company (Commercial, Trading Or Professional License) |

|

Anniversary date |

| Local Company (General Trading) |

|

Anniversary date |

Africa

Seychelles

Seychelles| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| International Business Company (IBC) |

|

Anniversary date |

Mauritius

Mauritius| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Global Business Company (GBC 1) |

|

01 January of each year |

| Authorised Company (AC) |

|

01 January of each year |

America

Delaware (United States of America)

Delaware (United States of America)| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Jun 01st Annually |

| Corporation (C-Corp or S-Corp) |

|

March 01st Annually |

United States of America

United States of America![]() Alaska

Alaska

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Due every 2 years, starting from when you filed your Initial Report. |

| Corporation (C-Corp or S-Corp) |

|

Due every 2 years, starting from when you filed your Initial Report. |

![]() Alabama

Alabama

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Arkansas

Arkansas

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

May 1st every year |

| Corporation (C-Corp or S-Corp) |

|

May 1st every year |

![]() Arizona

Arizona

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

No Annual Report is required. |

| Corporation (C-Corp or S-Corp) |

|

Due annually by anniversary of formation or registration. You can start filing 3 months prior. |

![]() California

California

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

15th day of the 4th month after the beginning of your tax year |

| Corporation (C-Corp or S-Corp) |

|

15th day of the 4th month after the close of your tax year |

![]() Colorado

Colorado

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Connecticut

Connecticut

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Delaware

Delaware

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Jun 01st Annually |

| Corporation (C-Corp or S-Corp) |

|

March 01st Annually |

![]() Florida

Florida

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Georgia

Georgia

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Hawaii

Hawaii

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Iowa

Iowa

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Idaho

Idaho

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Illinois

Illinois

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Indiana

Indiana

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Kansas

Kansas

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Kentucky

Kentucky

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Louisiana

Louisiana

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Massachusetts

Massachusetts

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Maryland

Maryland

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Maine

Maine

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Michigan

Michigan

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Minnesota

Minnesota

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Missouri

Missouri

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Mississippi

Mississippi

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Montana

Montana

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() North Carolina

North Carolina

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() North Dakota

North Dakota

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Nebraska

Nebraska

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() New Hampshire

New Hampshire

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() New Jersey

New Jersey

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() New Mexico

New Mexico

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Nevada

Nevada

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() New York

New York

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Ohio

Ohio

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Oklahoma

Oklahoma

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Oregon

Oregon

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Pennsylvania

Pennsylvania

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Rhode Island

Rhode Island

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() South Carolina

South Carolina

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() South Dakota

South Dakota

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Tennessee

Tennessee

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Texas

Texas

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Utah

Utah

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Virginia

Virginia

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Vermont

Vermont

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Washington

Washington

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Wisconsin

Wisconsin

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() West Virginia

West Virginia

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

![]() Wyoming

Wyoming

| Type Of Incorporation | Penalty Fees | Due Date |

|---|---|---|

| Limited Liability Company (LLC) |

|

Anniversary date |

| Corporation (C-Corp or S-Corp) |

|

Anniversary date |

FAQs

01 How to set up an offshore company?

02 What is the difference between a holding company and an investment company?

Fresh entrepreneurs oftentimes cannot tell the difference between a holding company and an investment company. While they do have a lot of similarities, holding companies and investment companies each have their distinct purposes.

A holding company is a parent business entity that holds the controlling stock or membership interests in its subsidiary companies. The cost to set up a holding company varies depending on the legal entity it is registered with, usually a corporation or an LLC. Large businesses usually set up a holding company because of multiple benefits it brings, including: Protecting assets, reducing risk and tax, no day-to-day management, etc.

An investment company, on the other hand, does not own or directly control any subsidiary companies, but rather is engaged in the business of investing in securities. Setting up an investment company is different from setting up a holding company, as they can mostly be formed as a mutual fund, a closed-ended fund, or a unit investment trusts (UIT). Furthermore, each type of investment company has its own versions, such as stock funds, bond funds, money market funds, index funds, interval funds, and exchange-traded funds (ETFs).

03

Download & Form

Application Formation Form LLP LLC

Read document

DownloadApplication for Limited Company Singapore

Read document

Download