Airwallex vs. PayPal, Which One Is Better For Dropshipping

08-02-2023

It might be difficult to select the best online payment platform. You must select what is best for you and your company while also being conscious of the expenses involved. A high level of trust is necessary when choosing the best payment gateway. For starters, you must be absolutely assured that the platform is secure enough to process the transaction safely. The client’s information must also be kept secure and not disclosed to third parties. Here is a comparison between the two most prominent online payment methods to help you choose the right method for your company.

What is Airwallex and PayPal

PayPal is an online payment platform that facilitates payments between individuals and businesses with a website and mobile application that allows payments between parties via online money transfer. PayPal customers create an account and connect it to a checking account, credit card, or both. Previously an eBay division, PayPal was separated into a new corporation in 2015.

Consumers may transfer money and pay bills rather easily. Whether the receiver has a PayPal account or not, money can be sent to any email or phone number. On the other hand, users must give a credit card, debit card, or bank account in order to set up an account, and they must also supply an email address.

A global leader in financial technology, Airwallex provides software as a service and financial services (SaaS). The firm, a financial services platform, was established in 2015 in Melbourne, Australia, and offers foreign currency transactions to companies via a secure banking network and its API. In addition to other services, it also offers bank accounts and it is the third-largest technological unicorn firm in Australia.

Airwallex is a service that only accepts corporate accounts, users cannot create personal accounts with it. Users must submit papers, detail upcoming transactions with Airwallex, and provide information about their company.

Comparing Airwallex and PayPal in Dropshipping

Airwallex

Pros:

- Multi-currency support: Airwallex supports over 130 currencies, allowing businesses to deal in their native currency and save conversion fees. This implies that clients may pay in their native currency, such as USD, and they can receive and store USD without having to convert it back.

- Global payment network: Airwallex is a large worldwide payment network that allows companies to accept payments from all around the world. This makes it excellent for companies who operate in numerous countries or have consumers from various nations.

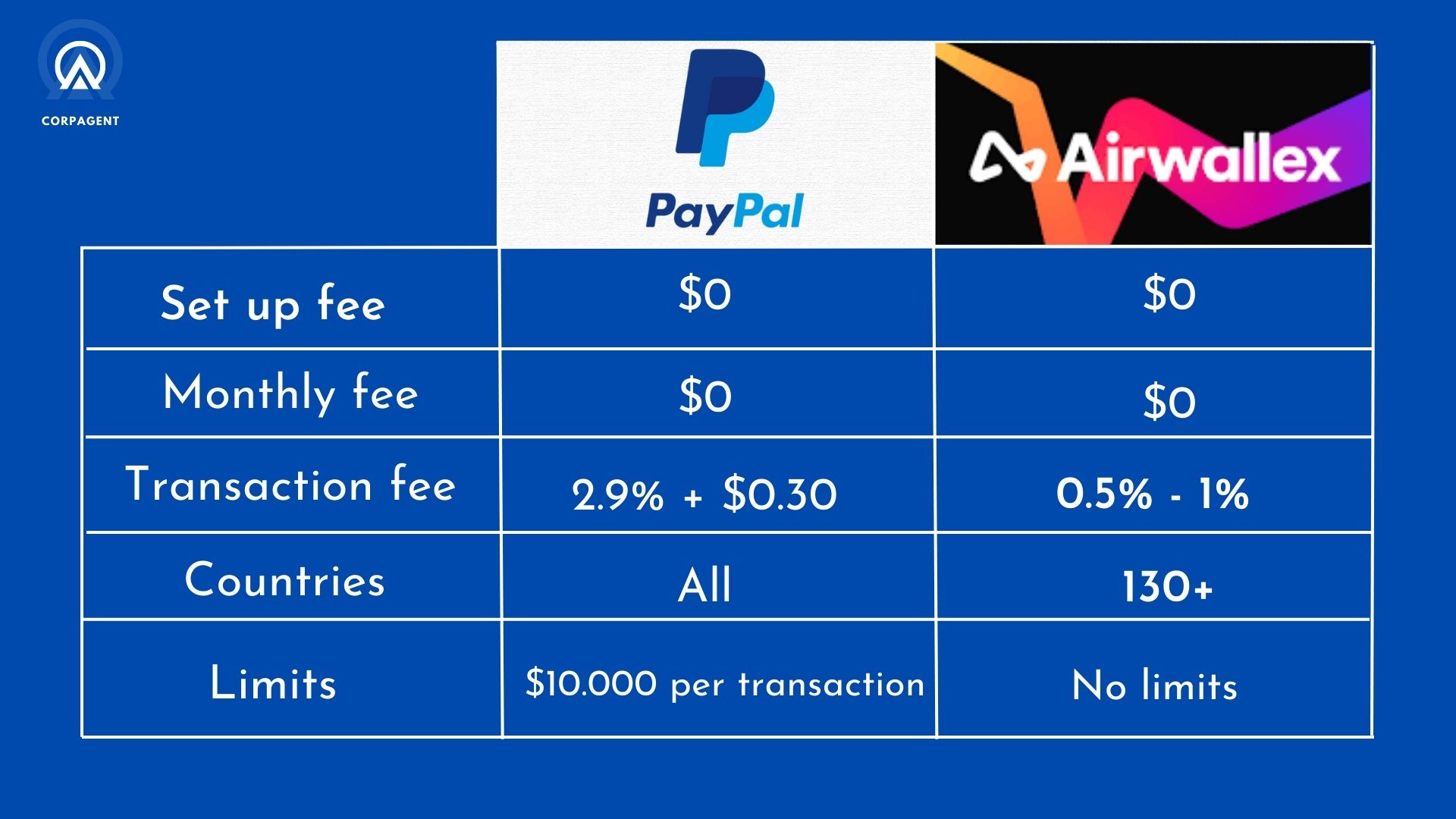

- Low transaction prices: When compared to typical payment gateways, Airwallex charges lower transaction fees, making it a cost-effective choice for dropshipping firms. There is no cost to establish an Airwallex account, and there are no monthly fees. Airwallex instead makes money from services like international SWIFT transfers and foreign currency transactions.

- Integration with major e-commerce systems: Airwallex connects with popular e-commerce platforms such as Shopify, Magento, and WooCommerce, making transactions simple to set up and administer.

- API integration : Automate key financial processes, such as payment workflows, and streamline account management.

Cons:

- Limited availability: Airwallex is now only available in a few countries, making it inaccessible to dropshipping enterprises in other locations.

- Limited customer support: Airwallex does not have a dedicated customer support team, which makes it difficult to provide assistance. If you have a question and want to talk with an Airwallex representative, you may fill out a form on their support website or call a local Airwallex directly.

PayPal

Pros:

- A widely known brand: PayPal is a well-established and well recognized brand, making it simple for customers to trust and utilize. PayPal is a broad-reaching, adaptable eCommerce payment gateway solution that works with most platforms and is supported in more than 200 countries.

- Worldwide payment system: PayPal offers a large worldwide payment network, facilitating the receipt of funds from all across the world. Moreover, it’s popular in the dropshipping sector because of its security and convenience of usage.

- Customer protection: PayPal provides consumer protection, guaranteeing that both businesses and customers are covered in the case of a dispute. Customers don’t have to share all of their financial details when making purchases with PayPal. PayPal secures information by processing each transaction with advanced encryption.

- Ease of use: PayPal is extremely user-friendly and simple to operate. PayPal is incredibly straightforward and easy to use, whether you are purchasing an item online or setting up PayPal as a payment option for your business. Setting up a PayPal account is likewise free and requires simply a valid e-mail address. Linking your credit cards and bank accounts to your PayPal account for withdrawals and financing simplifies online purchases.

Cons:

- Higher transaction fees: When compared to alternative payment gateways, PayPal has higher transaction fees, making it less cost-effective for dropshipping enterprises. Fees are higher than those charged by a regular merchant (credit card processing) account.

- Limited currency support: PayPal only supports a restricted number of currencies, making it difficult for companies to deal in their local currency.

- Complex chargeback process: The chargeback procedure may be complex and time-consuming, making it difficult for firms to manage disputes.

- PayPal Places Accounts on Hold: PayPal accounts can be frozen without notice, which can be terrible for your business.

Conclusion

Payment gateways such as Airwallex and PayPal can be used for dropshipping. The decision between the two will be based on your unique demands and company objectives.

Airwallex is a payment gateway that allows businesses to transmit and receive payments in many currencies. This makes it excellent for companies who operate in numerous countries or have consumers from various nations. Airwallex also has a mobile app that allows you to handle your payments while on the go.

PayPal, on the other hand, is a well-known payment gateway that is frequently utilized worldwide. It is simple to use, and it integrates seamlessly with many e-commerce platforms, making it a popular choice for dropshipping firms. PayPal also provides buyer and seller security through its buyer protection policy, which covers the majority of transactions.

To summarize, both Airwallex and PayPal offer pros and cons, and the decision between the two will be based on your unique demands. Airwallex may be the ideal option for you if you need a payment gateway that supports many currencies and has a mobile app. PayPal may be the ideal option for you if you are searching for a commonly used payment gateway that is simple to use and provides buyer and seller safety.

CorpAgent is also a long-time provider of corporate services including payment gateway setup and underwriting. Send us an inquiry to admin@corpagent.asia, or contact us here.

Related content about Payment Gateways

See CorpAgent’s Exclusive: PayPal Pro Underwriting + Singapore Company Package

See CorpAgent’s Exclusive: PayPal Pro Underwriting + Hong Kong Company Package

Other News

Singapore VS Hong Kong : Where is the best place to do business 2023?

Singapore and Hong Kong have been vying for dominance as Asia’s ‘Best Place to Do Business’ for decades. Both regions have enticed international investors with tax-friendly regulations, simple firm incorporation procedures, and superb infrastructure, among other things. Although Hong Kong has a longer history as a corporate center, Singapore has quickly caught up, eroding Hong Kong’s supremacy in the area. Singapore has been fast to implement business-friendly regulations that have attracted the majority of global companies to build their Asian presence on its shores.

What documents are required for opening a business bank account in Singapore 2023?

When you’re ready to start taking or spending money as your business, open a business account. A business bank account keeps you legally compliant and safe. It also has advantages for your customers and workers.

Today, we’ll look at Singapore’s banking business, which is a sophisticated financial ecosystem of local and foreign institutions. You will learn about the procedures for creating a corporate bank account, the required documentation, and the variety of banking services. And if you’re interested in opening a business bank account in Singpore, we’ll provide you with consultancy to help you, please contact us through https://corpagent.asia/

RISKS & TIPS FOR OPENING A BANK ACCOUNT FOR START-UPS IN HONG KONG

The difficulty of obtaining commercial bank accounts in Hong Kong has been well – recognized in recent years. It is also really complicated. Despite media attention and pressure from the Hong Kong Monetary Authority, InvestHK, Chambers of Commerce, and Hong Kong business organizations, opening bank accounts remains difficult for start-ups and small and medium-sized firms in particular.

Top 3 Crypto Exchanges Singapore 2023

Singapore is a prominent financial center that has experienced an increase in cryptocurrency use. Investors are seeking for the finest crypto exchange in Singapore, with up to 93% of its population having moderate knowledge of the crypto business.

This article will guide you some newest and safest pros and cons, provided base on top reviewers of top 3 crypto exchanges in Singapore: