What documents are required for opening a business bank account in Singapore 2023?

25-05-2023

When you’re ready to start taking or spending money as your business, open a business account. A business bank account keeps you legally compliant and safe. It also has advantages for your customers and workers.

When you’re ready to start taking or spending money as your business, open a business account. A business bank account keeps you legally compliant and safe. It also has advantages for your customers and workers.

Today, we’ll look at Singapore’s banking business, which is a sophisticated financial ecosystem of local and foreign institutions. You will learn about the procedures for creating a corporate bank account, the required documentation, and the variety of banking services. And if you’re interested in opening a business bank account in Singpore, we’ll provide you with consultancy to help you, please contact us through https://corpagent.asia/.

1. Banks in Singapore

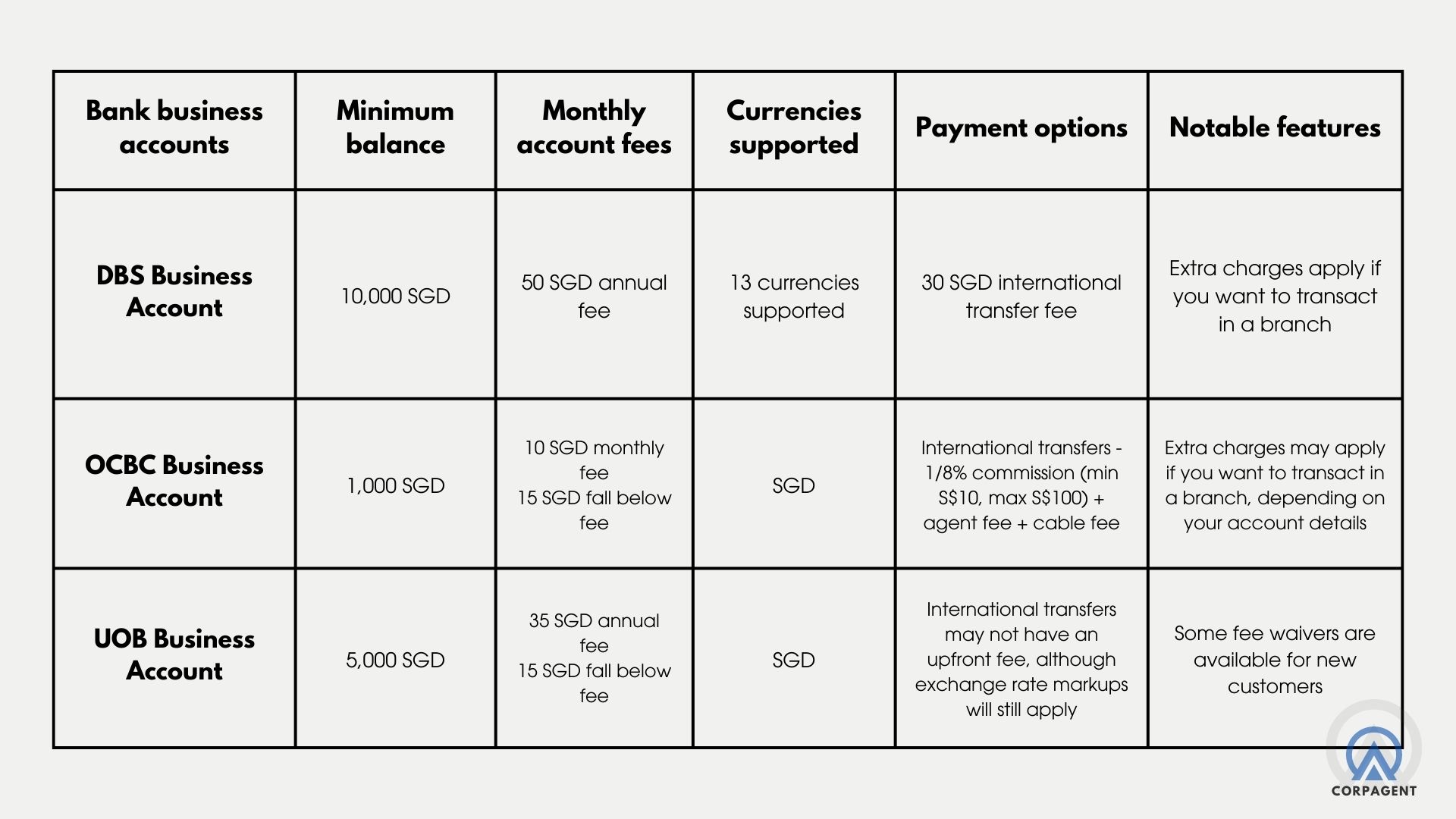

DBS Commercial Account

DBS offers a variety of SME banking products as well as corporate accounts for bigger businesses. The DBS Business multi-currency account is a fantastic alternative for smaller enterprises.

You’ll have simple access to online and mobile banking options, but you should be aware that there may be additional fees if you wish to use branch services.

If your account is totally locally owned and registered, you may be able to complete registration online, more complicated firms may need to register and then meet with a DBS representative to discuss their needs:

- Maintain an account with SGD and 12 other currencies.

- Depending on how your account is set up and packaged, you may receive some free transactions, including local payments.

- Full online and digital assistance, as well as a wide choice of services from one of the region’s leading banks

- Some accounts may be opened online, eliminating the need to visit a bank location.

See more on: DBS Business multi-currency account

Business Account at OCBC

OCBC business bank accounts provide products for new enterprises and entrepreneurs, as well as accounts for bigger businesses with specialized needs.

We’ve chosen the OCBC digital business account as a possible option. You’ll save money because there are no late fees or minimum balance requirements, and the monthly cost is only SGD. Sending local transfers is normally free, and because the account is geared at startups, there are many handy tools for young and expanding businesses.

- Get a comprehensive set of business and financial analytics tools to help you track and manage your money.

- Monthly costs are cheap, but fall below charges may apply.

- Support for emerging enterprises that includes advice and coaching

- In-person payment methods, such as QR payment services

See more on: OCBC Business Banking Singapore

UOB Commercial Account

The UOB Business account is the business account that UOB recommends for startups and new enterprises. Customers may manage their money online and use the UOB BizSmart digital banking capabilities with this account.

There are also free local payments and specialized FX expert help when sending money internationally:

- Cost reductions for new users, including free yearly cost for the first year.

- Transfer fees may not apply to international payments; nevertheless, exchange rates may involve a markup.

- Local payments offer fee rebates up to account limitations, and depending on the promotions running at the moment

- There is no fall below fee for the first 12 months after the account is opened.

See more on: UOB eBusiness Account

2. Documents required to open a business bank account

You will need to prepare some paperwork regardless of whatever bank you select. These paperwork may change significantly depending on the bank you choose. However, you will normally require:

- A copy of the company’s incorporation certificate

- A copy of the firm’s business profile obtained from the company registrar

- A copy of the Memorandum and Articles of Association (MAA) of the firm

- A copy of the company’s resolution naming the signatories to the account opening.

- Copies of all company directors, signatories, and ultimate beneficial owners (those who will directly benefit from business income) passports or Singapore national identity cards

- Proof of residence address of the company’s directors and ultimate beneficial owners (papers must be dated within the past three months)

- A copy of the company’s resolution

- A copy of the company constitution

- Forms for creating a business bank account, signed by signatories

These copies must be ‘Certified True’ by the company secretary or a director of the company. If you are unable to make copies yourself, many banks will assist you in making them at their branches.

Opening a business bank account usually takes less than a day. However, depending on the sort of business you want to manage, your preferred bank may need extra papers for additional verification.

3. Open a business bank account in Singapore from overseas

Many Singapore banks provide online banking services, including the creation of a business bank account. Depending on the sort of business bank account you choose, certain banks may need your actual presence. You may also be required to provide extra documentation for verification.

All documents must be translated into English. It is your company’s responsibility to ensure that any non-English papers are translated and validated by the company’s signatories.

4. Is it hard to open a business bank account in Singapore?

Finding the best business account is critical. You’ll be able to better organize and manage your money, as well as save money on day-to-day banking and financial services. After choosing the most suitable bank and preparing full paperworks, opening a business bank account can become easier than ever. In case you have trouble with this issue, CorpAgent Global can help you!

Having been in the industry for more than 10 years of providing corporate services to clients across five markets, the extensive range of CorpAgent’s company formation services including international company formation and post-company formation supports, related to legal services and corporate governance. From CorpAgent’s understanding, a company without a corporate bank account is considered impractical.

Thus, we offer banking support services in many jurisdictions. Depending on the client’s preferences, they can either open an account at the bank they prefer or go with our recommended bank choices that belong to the best international overseas branch network and internet banking service.

Please contact us via https://corpagent.asia/

See more OPENING BANK content here:

https://corpagent.asia/factors-choosing-offshore-banking-jurisdiction

https://corpagent.asia/easiest-countries-to-open-an-offshore-bank-account/

Other News

Singapore VS Hong Kong : Where is the best place to do business 2023?

Singapore and Hong Kong have been vying for dominance as Asia’s ‘Best Place to Do Business’ for decades. Both regions have enticed international investors with tax-friendly regulations, simple firm incorporation procedures, and superb infrastructure, among other things. Although Hong Kong has a longer history as a corporate center, Singapore has quickly caught up, eroding Hong Kong’s supremacy in the area. Singapore has been fast to implement business-friendly regulations that have attracted the majority of global companies to build their Asian presence on its shores.

What documents are required for opening a business bank account in Singapore 2023?

When you’re ready to start taking or spending money as your business, open a business account. A business bank account keeps you legally compliant and safe. It also has advantages for your customers and workers.

Today, we’ll look at Singapore’s banking business, which is a sophisticated financial ecosystem of local and foreign institutions. You will learn about the procedures for creating a corporate bank account, the required documentation, and the variety of banking services. And if you’re interested in opening a business bank account in Singpore, we’ll provide you with consultancy to help you, please contact us through https://corpagent.asia/

RISKS & TIPS FOR OPENING A BANK ACCOUNT FOR START-UPS IN HONG KONG

The difficulty of obtaining commercial bank accounts in Hong Kong has been well – recognized in recent years. It is also really complicated. Despite media attention and pressure from the Hong Kong Monetary Authority, InvestHK, Chambers of Commerce, and Hong Kong business organizations, opening bank accounts remains difficult for start-ups and small and medium-sized firms in particular.

Top 3 Crypto Exchanges Singapore 2023

Singapore is a prominent financial center that has experienced an increase in cryptocurrency use. Investors are seeking for the finest crypto exchange in Singapore, with up to 93% of its population having moderate knowledge of the crypto business.

This article will guide you some newest and safest pros and cons, provided base on top reviewers of top 3 crypto exchanges in Singapore: