BVI Versus Cayman Island For Offshore Company Incorporation

13-12-2022

One of the questions we have heard the most during our years in the business is: What are the pros and cons of each tax haven?

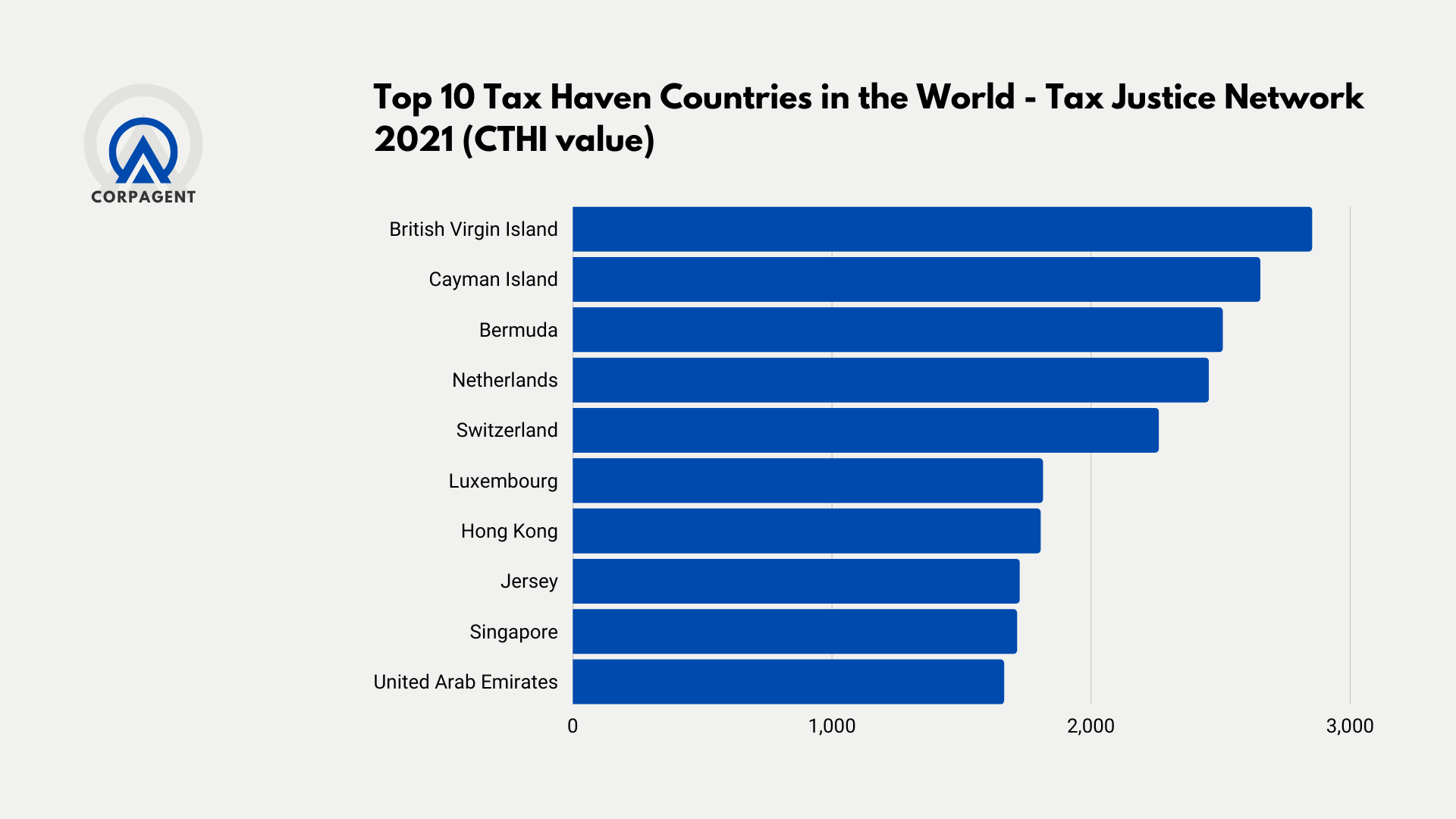

In the recent years, BVI and Cayman Island have risen to be two among the most desirable offshore jurisdictions. According to the Tax Justice Network, BVI and Cayman Island top the tax haven list (see below). BVI and Cayman Island, despite both being autonomous British Overseas Territories and attractive tax havens, are not identical. Choosing BVI or Cayman Island to set up an offshore company is a complex matter that requires consideration of all of the client’s circumstances, including the proposed nature of the business of the offshore company, any expansion and financing plans, and the client’s specific structuring objectives.

Already know the differences? Go to CorpAgent’s BVI Company Formation packages

Cayman Island Company Formation

To a certain extent, market practice also plays an important role with respect to certain types of transactions such as IPOs, captive insurance, institutional investment funds, special purpose acquisition companies (SPACs) and collateralised loan obligations.

Similarities between BVI and Cayman Island To Offshore

There are many similarities between the advantages that BVI and Cayman companies offer, as follows:

- Stability and reliability. The BVI and the Cayman Islands are autonomous British Overseas Territories that apply English common law rules and principles. There is a well tested and efficient judicial system in both jurisdictions, with a final right of appeal to the Privy Council.

- Tax neutrality. There are no income, corporate, capital gains or wealth taxes, withholdings or other similar taxes imposed on BVI and Cayman companies as a matter of local law.

See more: What Makes BVI An Attractive Offshore Jurisdiction?

Pros And Cons Of Opening An Offshore Company In BVI.

- Corporate flexibility. The objects, capacity and powers of a BVI and a Cayman company are generally unrestricted. Most decisions can be taken by the board of directors of the relevant company, with only certain matters requiring shareholder approval. There are also no exchange controls and restrictions on financial assistance as a matter of BVI and Cayman Islands law.

- Regulation is light touch. Most BVI and Cayman companies do not need any regulatory approvals to complete corporate and finance transactions as a matter of local law.

Differences

There are also significant differences between BVI and Cayman companies. For example:

- Incorporation and maintenance costs. In terms of the government fees charged for incorporation and annual maintenance, BVI companies are cheaper to incorporate and maintain in good standing than Cayman companies. Therefore, a BVI company may be a more appropriate vehicle for a straightforward corporate holding structure. This most likely explains why there were more than 370,000 active BVI companies at the end of 2021, compared to 117,000 Cayman companies at the end of the same period.

- Confidentiality. Although both jurisdictions offer a high level of confidentiality, there are differences in approach. While the constitutional documents of a Cayman company are confidential, the memorandum of association and articles of association of a BVI company are a matter of public record. Clients that need to include commercially sensitive provisions in the constitutional documents of a company, such as pursuant to a shareholders’ agreement, may therefore wish to incorporate a Cayman company. Clients that wish to safeguard the names of the company directors may wish to incorporate a BVI company.

- Joint ventures. A BVI company may, and typically does, adopt specific provisions in its articles of association to abrogate the fiduciary duties that are generally imposed on directors to act in the best interests of all of the shareholders in a joint venture, and instead permit them to act for the benefit of the party appointing them.

- IPOs and SPACs. Traditionally, Cayman companies have been the vehicle of choice for listings in Asia. For example, more than 60% of all companies listed on the main board of the Stock Exchange of Hong Kong are incorporated in the Cayman Islands. This compares with only a handful of companies that are BVI incorporated. The dominance of Cayman companies with respect to listed entities has also manifested itself with respect to SPACs. For example, Temasek-backed Vertex Technology Acquisition Corporation, a SPAC incorporated in the Cayman Islands, was the first SPAC listed on the Singapore Exchange.

- Structured finance products. BVI and Cayman companies are widely utilized as special purpose vehicles in structured finance transactions due to the off-balance sheet and bankruptcy-remote advantages that they offer. Both jurisdictions are also recognized as creditor friendly due to the range of self-help remedies available to secured creditors in enforcement. However, there are important differences. The BVI has a public security registration system, whereas security interests that are granted by a Cayman company are a matter of private record. Recent changes in European regulations make it impermissible to market certain collateralised loan obligation deals to European investors using a Cayman special purpose vehicle, so a BVI company may be more appropriate.

| BVI | Cayman Island | |

|---|---|---|

| Stability and reliability | ||

| Tax neutrality | ||

| Corporate flexibility | ||

| Regulations | ||

| Incorporation and maintenance costs | ||

| Confidentiality | Constitutional documents are confidential | Name of company directors are confidential |

| Joint ventures | ||

| IPOs and SPACs | ||

| Structured finance products |

Conclusion

As said, there is no absolute best tax haven for everyone, even though we are confident that BVI and Cayman Island are two among the most chased-after options for offshore company opening in the recent years. If your business is simply looking for cheaper option, we recommend the BVI. If your company is looking for protection of the director’s identities, we also recommend the BVI. However, if your company is looking for listings, Cayman Island companies would be preferable.

See More:

CorpAgent is a long-time provider of corporate services. Send us an inquiry to admin@corpagent.asia, or fill in the Contact Form.

Other News

Singapore VS Hong Kong : Where is the best place to do business 2023?

Singapore and Hong Kong have been vying for dominance as Asia’s ‘Best Place to Do Business’ for decades. Both regions have enticed international investors with tax-friendly regulations, simple firm incorporation procedures, and superb infrastructure, among other things. Although Hong Kong has a longer history as a corporate center, Singapore has quickly caught up, eroding Hong Kong’s supremacy in the area. Singapore has been fast to implement business-friendly regulations that have attracted the majority of global companies to build their Asian presence on its shores.

What documents are required for opening a business bank account in Singapore 2023?

When you’re ready to start taking or spending money as your business, open a business account. A business bank account keeps you legally compliant and safe. It also has advantages for your customers and workers.

Today, we’ll look at Singapore’s banking business, which is a sophisticated financial ecosystem of local and foreign institutions. You will learn about the procedures for creating a corporate bank account, the required documentation, and the variety of banking services. And if you’re interested in opening a business bank account in Singpore, we’ll provide you with consultancy to help you, please contact us through https://corpagent.asia/

RISKS & TIPS FOR OPENING A BANK ACCOUNT FOR START-UPS IN HONG KONG

The difficulty of obtaining commercial bank accounts in Hong Kong has been well – recognized in recent years. It is also really complicated. Despite media attention and pressure from the Hong Kong Monetary Authority, InvestHK, Chambers of Commerce, and Hong Kong business organizations, opening bank accounts remains difficult for start-ups and small and medium-sized firms in particular.

Top 3 Crypto Exchanges Singapore 2023

Singapore is a prominent financial center that has experienced an increase in cryptocurrency use. Investors are seeking for the finest crypto exchange in Singapore, with up to 93% of its population having moderate knowledge of the crypto business.

This article will guide you some newest and safest pros and cons, provided base on top reviewers of top 3 crypto exchanges in Singapore: